Additional information and useful links

Climate Policy Initiative (CPI) provides comprehensive data and analysis of global climate finance flows, including sources, intermediaries, financial instruments, activities and sectors financed

https://www.climatepolicyinitiative.org/climate-finance-tracking/

https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2023/

International Renewable Energy Agency (IRENA) is a source of in-depth knowledge and reports (https://www.irena.org/Publications) on recent trends in renewable energy policies, technologies, resources and financing. Relevant examples of such reports are:

IRENA (2023), Low-cost finance for the energy transition

https://www.irena.org/Publications/2023/May/Low-cost-finance-for-the-energy-transition

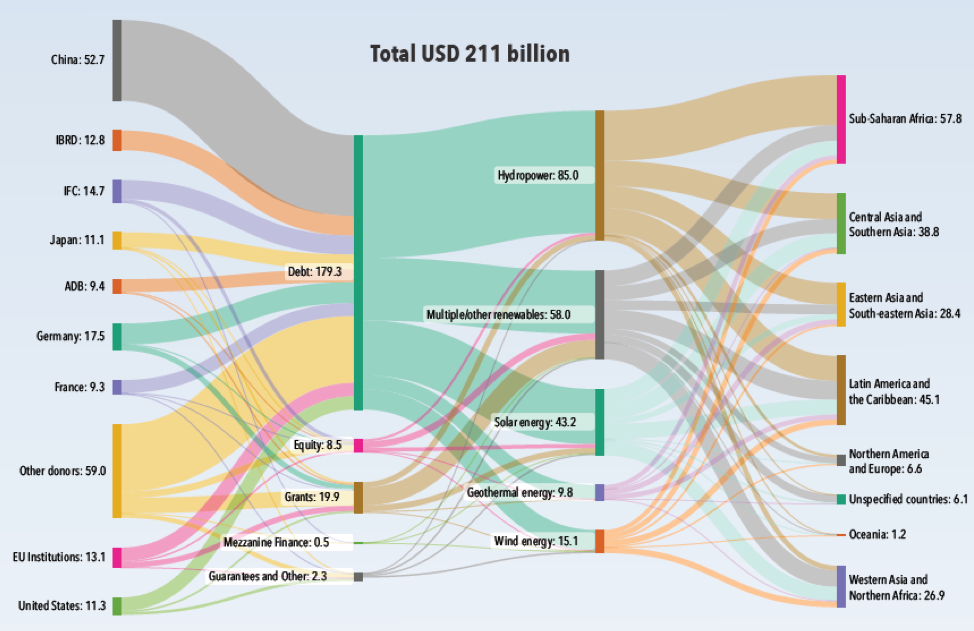

IRENA and CPI (2023), Global landscape of renewable energy finance

https://www.irena.org/Publications/2023/Feb/Global-landscape-of-renewable-energy-finance-2023

Policy Learning Platform managed by Interreg Europe serves as support information and knowledge hub for RE and EE policy solutions in EU

https://www.interregeurope.eu/policy-solutions

Policies and Measures Database of International Energy Agency (IEA) provides access to information on past, existing or planned government policies and measures to improve energy efficiency, support the development and deployment of renewables and other clean energy technologies

Useful overview, descriptions and lists of international sources and institutions for financing of RE and EE projects could be found in:

Accessing International Financing for Climate Change Mitigation – A Guidebook for Developing Countries

Energy Efficiency Financial Institutions Group’s (EEFIG) Underwriting Toolkit is a valuable resource on financing of EE projects, extensively covering such topics as the types and nature of EE investments, their financing mechanisms, structures and contracts, EE project development and execution cycle, appraisal of risks and benefits of EE investments

https://valueandrisk.eefig.eu/introduction

De-risking Energy Efficiency Platform (DEEP) is the Europe’s largest energy efficiency project database, containing details on over 37,000 EE projects in buildings and industry